If you have ever wondered whether a loan, credit card, or EMI is a smart move or a mistake, you are already thinking about good debt vs bad debt, even if you do not use those exact words. Borrowing money is almost unavoidable at some point in life, but the kind of debt you take can either move you forward or quietly hold you back for years.

In this guide, you will understand what good debt vs bad debt really means, how to tell the difference in real‑life situations, and how to use a few simple rules before you sign anything. You will see that not all borrowing is evil, but not all borrowing is smart either. The goal is to help you make calm, informed decisions instead of emotional, rushed ones.

By the end, you should feel more confident about looking at any loan, EMI, or credit offer and deciding for yourself whether it is closer to good debt vs bad debt for your situation.

What Does Good Debt vs Bad Debt Actually Mean?

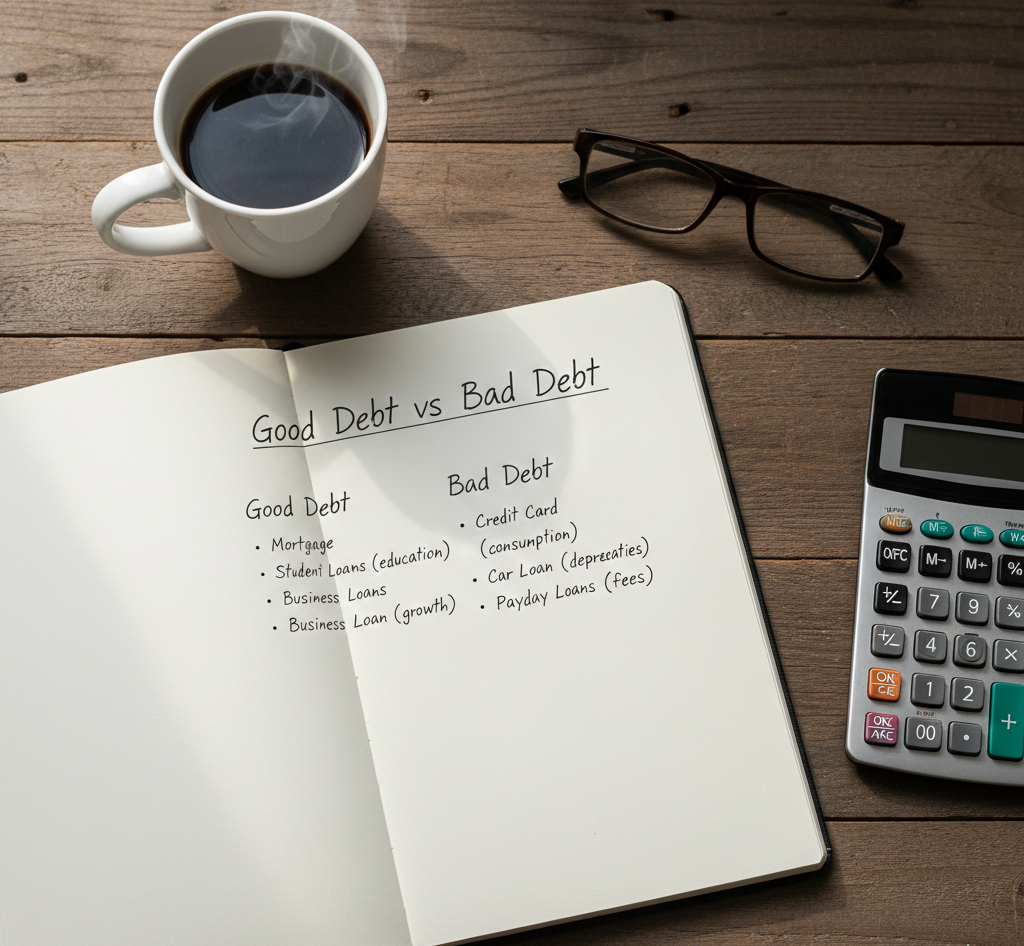

You cannot use the idea of good debt vs bad debt until you are clear about what each one is. In simple terms, good debt is borrowing that helps you grow your income, build useful assets, or improve your long‑term situation in a realistic, affordable way. Bad debt is borrowing that mainly funds short‑term wants, loses value quickly, or costs more than it gives back.

For example, a student loan that allows you to gain skills and enter a career with higher earning potential can be considered good debt if the terms are reasonable and you have a plan to repay it. A mortgage on a modest home you can afford, in an area that fits your life and work, often falls under good debt as well. In both cases, the debt is linked to something that can support or improve your future.

In contrast, expensive credit card balances for shopping you barely remember, payday loans with extremely high interest, or EMIs for luxury items you cannot truly afford are common examples of bad debt. Here, the debt funds things that do not increase your earning power or long‑term stability, and the interest often traps you in a cycle of repayment.

Of course, life is not always black and white. A car loan, for instance, can be closer to good debt vs bad debt depending on how you use the car, how much you borrow, and what alternatives you have. Instead of memorising fixed categories, it is better to understand the principles behind good debt vs bad debt so you can decide case by case.

For more formal explanations of different types of debt and how they work, you can explore resources like Investopedia’s overview of debt at https://www.investopedia.com/terms/d/debt.asp, but the core idea remains the same: what you borrow for, how much it costs, and how it affects your future.

Why Understanding Good Debt vs Bad Debt Matters

You might think that as long as you can make your monthly payments, you do not need to worry too much about good debt vs bad debt. Unfortunately, that is how many people end up feeling stuck, even with a decent income.

When you understand good debt vs bad debt, you start to see that not all equal monthly instalments are equal in impact. Two people might both be paying EMIs of the same amount, but one is paying for an asset that helps them earn or live more securely, while the other is paying for something that has already lost most of its value. On paper, both are “managing,” but their futures are very different.

Knowing the difference also protects you from clever marketing. Lenders, credit card companies, and buy‑now‑pay‑later services are very good at making every offer sound like an opportunity. If you do not think about good debt vs bad debt, you may accept offers simply because they are available or because “everyone is doing it,” without checking whether they match your actual goals.

There is also a mental health angle. Carrying too much bad debt often feels heavy, shameful, and confusing. You might avoid looking at statements or answering calls from unknown numbers. In contrast, when you focus on more good debt vs bad debt choices, the borrowing you do have tends to feel more like a tool than a burden, because you know why you took it and how it fits into your bigger plan.

In short, understanding good debt vs bad debt is not just about money. It is about control, clarity, and the ability to say yes or no to opportunities with a calm mind.

How to Decide If a Loan Is Good Debt or Bad Debt

When you are faced with a real decision—take this loan or not, buy this on EMI or wait, swipe this card or walk away—you need a simple way to evaluate good debt vs bad debt for that specific situation. You do not need complex maths; you need a few clear questions.

The first question is what you are getting in return. Ask yourself whether this borrowing is connected to something that will last or help you grow. Education that truly improves your skills, a reasonably priced home, tools for your business, or a car that is essential for your job can often lean toward good debt, provided the cost and terms are sensible. A latest‑generation phone just because it is on sale, or a luxury holiday you cannot pay cash for, usually lean toward bad debt.

The second question is how much it really costs. Do not look only at the monthly instalment. You need to know the interest rate, all the fees, and the total amount you will have paid by the end. High‑interest credit cards and short‑term loans are classic examples where the total cost pushes them firmly into bad debt. You can compare different products using online calculators or information from regulators like the US Consumer Financial Protection Bureau at https://www.consumerfinance.gov/consumer-tools/credit-cards/.

The third question is whether it fits comfortably into your cash flow. Even something that looks like good debt on paper becomes bad for you if the payments are so high that you cannot save, handle emergencies, or enjoy life at all. A safe guideline is that all your debt payments combined should still leave enough space for essentials, some savings, and reasonable day‑to‑day spending.

The final question is what happens if things go wrong. If you lose your job, face a health issue, or need to support family, will this new debt make everything collapse, or is there some flexibility? Thinking through worst‑case scenarios is not negative; it is part of making grown‑up decisions about good debt vs bad debt.

When you start to use these questions regularly, you develop an instinct. Over time, your quick reactions to offers and temptations will become more aligned with what is truly good debt vs bad debt for you.

Real‑Life Examples of Good Debt vs Bad Debt

Sometimes the idea of good debt vs bad debt feels abstract until you see how it plays out in daily decisions. Looking at a few common examples can help you recognise patterns in your own life.

Consider education. If you borrow a manageable amount to study a field with solid job prospects, at an institution where you have researched outcomes, that loan can lean toward good debt. It is supporting your ability to earn more over many years. On the other hand, taking on large, high‑interest loans for a course with poor job outcomes, simply because you feel pressured or did not research alternatives, might move that same category closer to bad debt.

Housing is another area. A mortgage for a simple home that fits your budget and location needs is often considered good debt vs bad debt because it builds ownership over time. However, stretching too far for a large, expensive property because of status or FOMO can turn housing debt into a heavy burden. If you are constantly anxious about every interest rate change, that “good debt” may not be so good for your actual life.

Look at cars. A basic, reliable car that lets you commute to work, deliver goods for your business, or access clients can be a form of good debt, especially if bought used at a reasonable price. In contrast, financing a luxury car with a huge loan mainly to impress others, when public transport or a cheaper option would work, falls clearly into bad debt territory.

Credit cards show good debt vs bad debt in a very sharp way. Using a card for planned purchases, paying it off in full each month, and collecting rewards or buyer protection can be a clever way to manage cash flow. But turning to cards to cover everyday expenses because your budget is not under control, and then carrying balances with high interest, is one of the most common forms of bad debt.

These examples show that the line between good debt vs bad debt is not about the category alone, but about the reasons, the amounts, and your wider financial situation.

Common Myths About Good Debt vs Bad Debt

When people talk about good debt vs bad debt, a few myths often appear. Clearing them up can prevent confusion and poor decisions.

One myth is that all debt is bad and should be avoided at any cost. While living completely debt‑free can be peaceful for some, it is not always realistic or necessary for everyone. Refusing any form of borrowing can limit your ability to study, start a business, or buy a home, especially if you do not come from a wealthy background. The goal is not to fear all debt, but to use good debt vs bad debt as a filter to decide when borrowing makes sense.

The opposite myth is that all debt for “assets” is automatically good. People sometimes justify big car loans, oversized homes, or even risky investments by calling them assets. But if the asset is dropping in value, not producing income, or constantly draining your cash, it may not be as “good” as it sounds. Labels do not change the reality of how a loan affects your life.

Another myth is that small debts do not matter. You might think, “It is just a small EMI” or “This card balance is not that big.” However, multiple small bad debts can stack up and put just as much pressure on you as one large one. When you think in terms of good debt vs bad debt, you consider the total picture, not just individual payments.

There is also the idea that you can always refinance or “fix it later.” While sometimes you can turn bad debt into slightly better debt by consolidating or negotiating, this is not guaranteed. Assuming that future you will somehow clean up every decision can lead to dangerous levels of bad debt today.

Being honest about these myths helps you approach good debt vs bad debt with clear eyes and fewer illusions.

How to Turn Bad Debt into Better Debt

Even with the best intentions, most people will end up with some bad debt at some point in their lives. The important question is what you do next. You can choose to ignore it and hope it disappears, or you can actively work to turn bad debt into better debt and eventually clear it.

The first step is awareness. List all your debts, including credit cards, personal loans, and any instalment plans. For each one, note the balance, interest rate, and minimum payment. This exercise can be uncomfortable, but it gives you a clear map of your current good debt vs bad debt situation.

Next, focus on reducing the most harmful debts first. High‑interest credit cards and short‑term loans usually sit at the top of the bad debt list. If possible, stop adding new charges to those accounts while you work on paying them down. You might also explore whether you can move balances to a lower‑interest option, but only if you have a solid plan not to build up new balances on the old accounts.

At the same time, adjust your spending so you are not creating more bad debt every month. This might mean cutting back on non‑essential expenses, delaying some wants, or finding small ways to boost your income. None of this is fun, but it is temporary. Every euro, dollar, or rupee you stop sending to bad debt can eventually be used for savings and investments instead.

If your bad debt feels overwhelming or is tied to the early years of your career, it can be helpful to follow a structured approach instead of improvising. Once you have a basic understanding of good debt vs bad debt, guides like Debt Payoff Plan: 7 Powerful Steps for Young Professionals can give you a step‑by‑step way to move from stress toward stability, even if you are not technically in your 20s anymore.

As you gradually clear bad debt and avoid taking on new harmful loans, your remaining borrowing—if any—starts to look more like good debt. You may still have a mortgage or a business loan, but the overall shape of your finances becomes healthier.

Final Thoughts: Using Good Debt vs Bad Debt as a Lifetime Filter

You will probably face borrowing decisions many times in your life: education, housing, vehicles, emergencies, opportunities, and sometimes temptations. You cannot control everything, but you can control how you think about these choices.

If you treat good debt vs bad debt as a simple lifetime filter, you will make fewer rushed decisions and more intentional ones. Before you sign, you can ask what this loan is really for, how much it truly costs, whether it fits your cash flow, and what it does to your long‑term picture. You can accept some forms of good debt that support your goals, and say no to bad debt that only adds weight without real benefit.

Over time, these choices build on each other. You may not feel the impact in a single month, but across years, the difference between a life full of mostly good debt vs bad debt choices becomes enormous. You will have more freedom, fewer regrets, and a much calmer relationship with money, knowing that borrowing is something you do thoughtfully, not something that just happens to you.

FAQ: Good Debt vs Bad Debt

Is it always bad to use a credit card?

No. Using a credit card for planned purchases and paying the full balance each month can be neutral or even slightly positive if you earn rewards and protect your purchases. It becomes bad debt when you carry balances at high interest and use the card to cover a lifestyle you cannot afford.

Can a student loan be considered good debt?

A student loan can lean toward good debt if it funds education that leads to realistic job opportunities and the total amount and interest are manageable compared to your expected income. If you borrow far more than you can ever repay for a low‑value course, it shifts toward bad debt.

Is a car loan good debt or bad debt?

A car loan can be closer to good debt vs bad debt if the car is essential for your work or business and you choose a modest, reliable vehicle within your budget. A large loan for a luxury car mainly for status, when cheaper transport would work, is usually bad debt.

How do I know if I have too much bad debt?

If your debt payments take up so much of your income that you cannot save, handle small emergencies, or ever feel relaxed about money, you likely have too much bad debt. Listing all your debts and their interest rates can show you how serious the situation is.

Can I turn bad debt into good debt?

The same loan does not magically become good, but you can move from a bad debt situation to a better one. By paying down high‑interest balances, avoiding new harmful borrowing, and focusing on debts that support your long‑term goals, your overall mix of good debt vs bad debt can improve significantly over time.